Posting this a couple days late and ran the portfolio a couple days over this year due to time committments elsewhere.

A couple of my picks delisted, so have calculated their return from start to delisting:

| start | final price | % change | ||

| source bio | delisting | 122.5 | 115 | -6.1% |

| contourglobal | scheme of arrangement | 256 | 251 | -2.0% |

| yamana | plan of arrangement | 395 | 475 | 20.3% |

| Portfolio Overall | 1 year performance | 3.8% | ||

| Ftse 350 | 1 year performance | 4144 | 4134 | -0.2% |

So a positive performance, beating ftse350 – but nothing exciting. But losing value when accounting for inflation so i’m still worse of than 1 year ago.

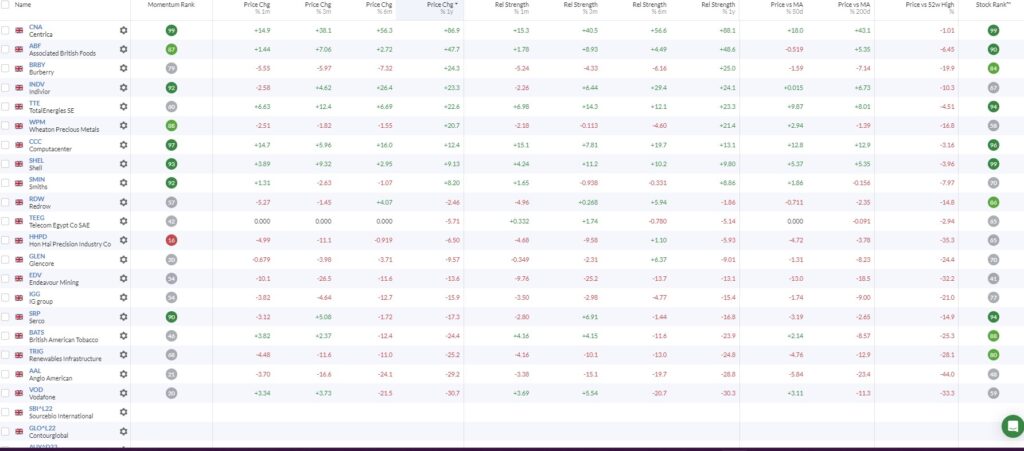

My last years 3 discretionary picks were all precious metals and they rose on average 9%. So my discretionary picks worked. I continue the theme with precious metals and this year my 3 picks were Endeavour mining, Anglo American and Wheaton Precious Metals as I think we are entering an era (5-10 years) of commodities out-performance.

Last years performance:

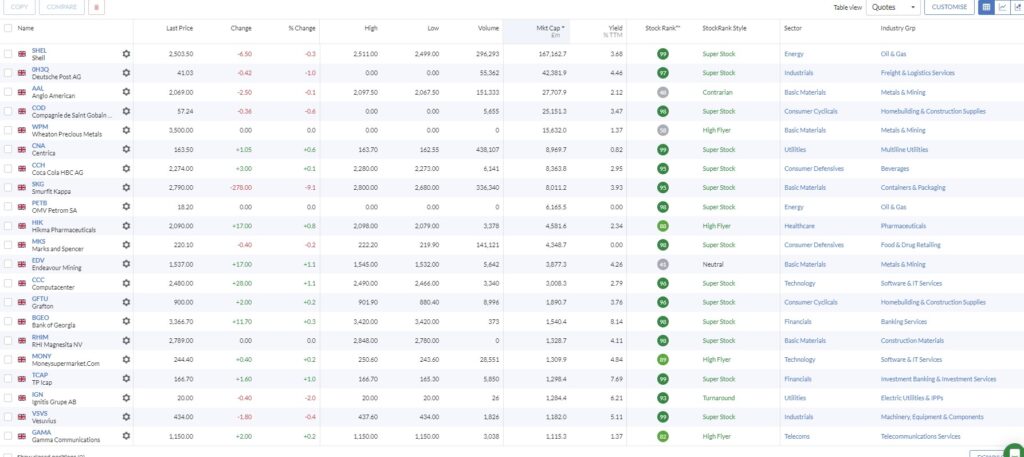

And my new picks are: