Below are the performances of my model portfolios in 2020.

See here for a reminder of their rules and make up.

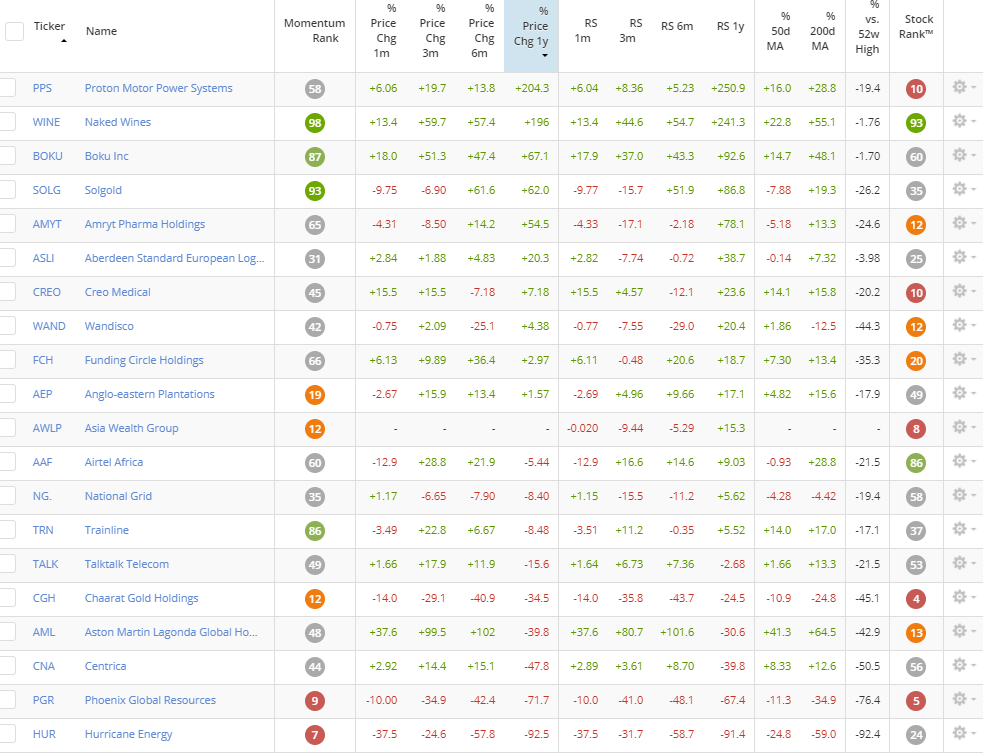

Its interesting that i did not want to pick Hurricane Energy as a mechanical short, i liked the look of it. It fell over 90% during the year and the mechanical short proved correct!

Summary

A poor performance! In the discretionary portfolios i had the longs up 13.2% BUT the shorts were up 54.8%. The complete opposite of what i’d like! The picture is repeated for the mechanical with longs up 1.1% and shorts up 14.5%. Ftse350 was down 13% for the year so when the long and short scores are combined (at their two thirds and one third weighting), the overall discretionary was UP 3.5% ish against FTSE 350 benchmark, the purely mechanical scoring -4.1% for the year is also up against benchmark. So doesnt feel as bad when looking at the benchmark but itstill feels terrible.

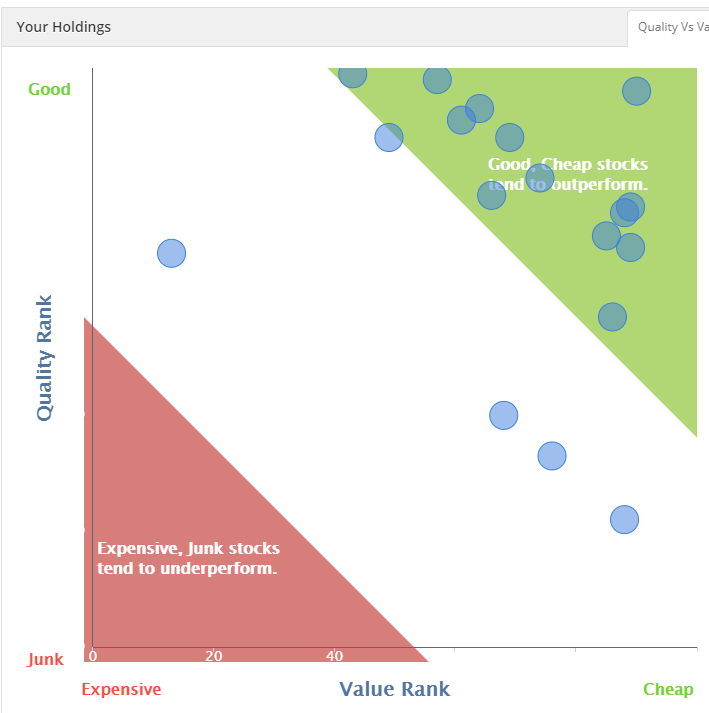

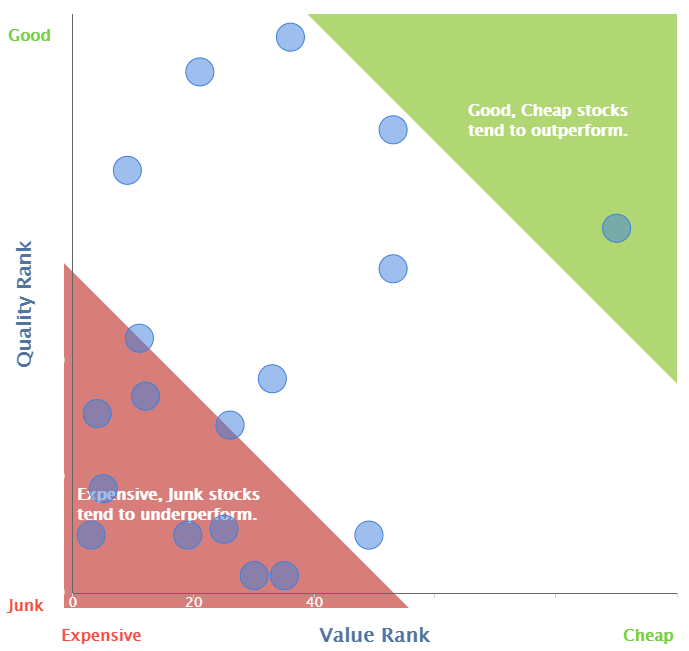

Despite the shorts doing better than the longs, it’s interesting to look at the stock ranks even now at the end of the year – for the discretionary portfolios – the long portfolio is still much higher in SR than the short. Interesting.

Detailed Portfolio Returns

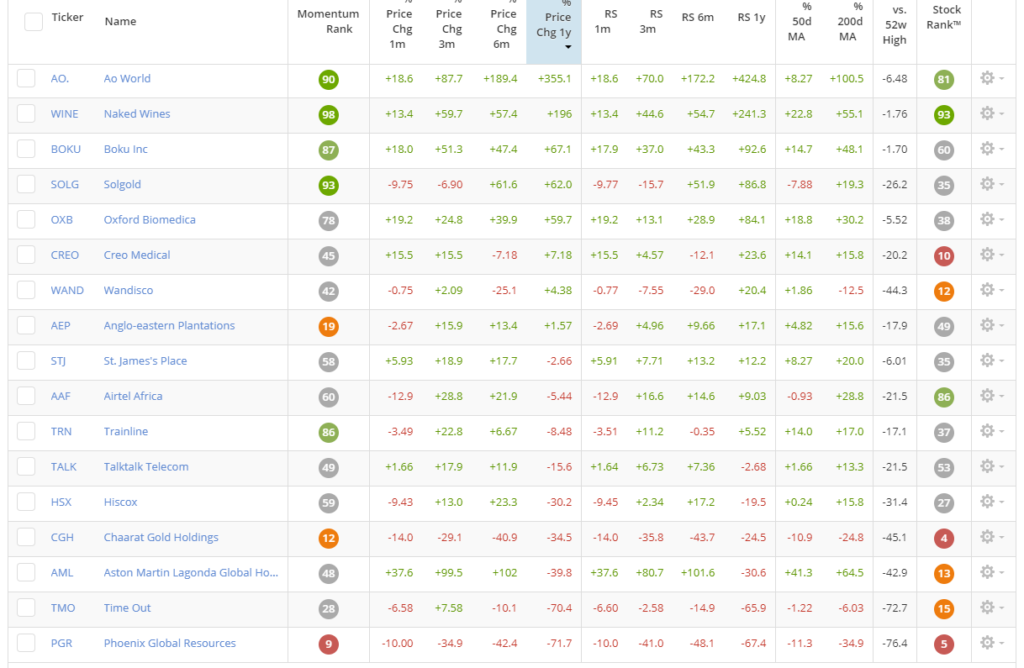

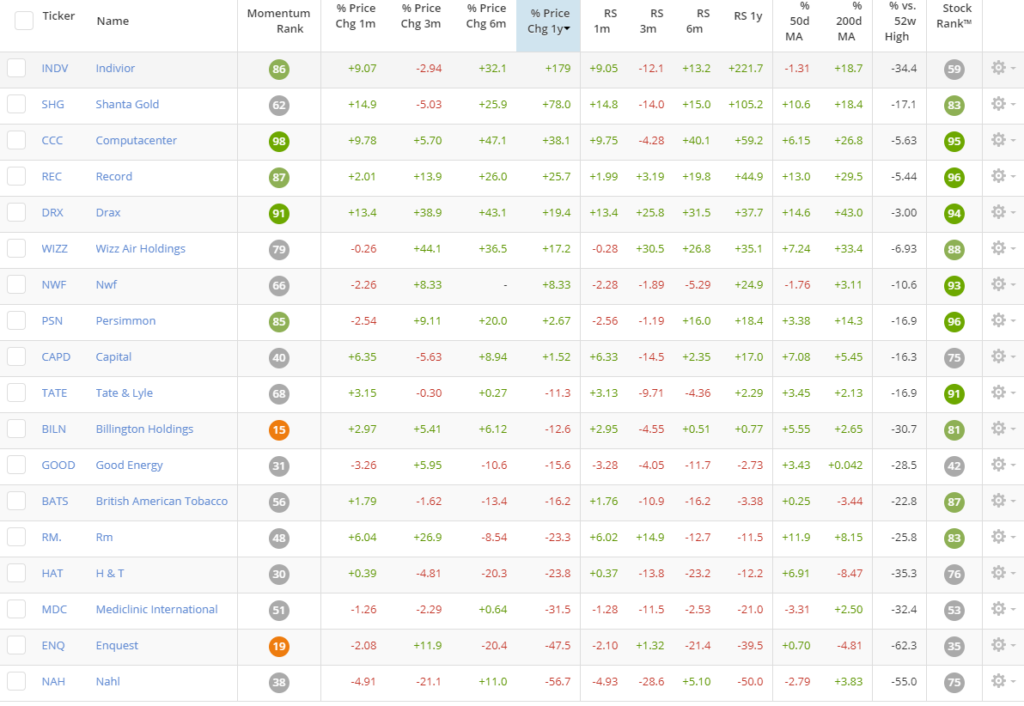

Mech NAPS Short 2020

Up 14.5%

Mech NAPS Long 2020

Up 1.1%

NAPS Discretionary Long 2020

Up 13.2%

NAPS Discretionary Short 2020

Portfolio is up 54.8% – a terrible performance! ITM power up over 700% with several others up close to or above 100%.