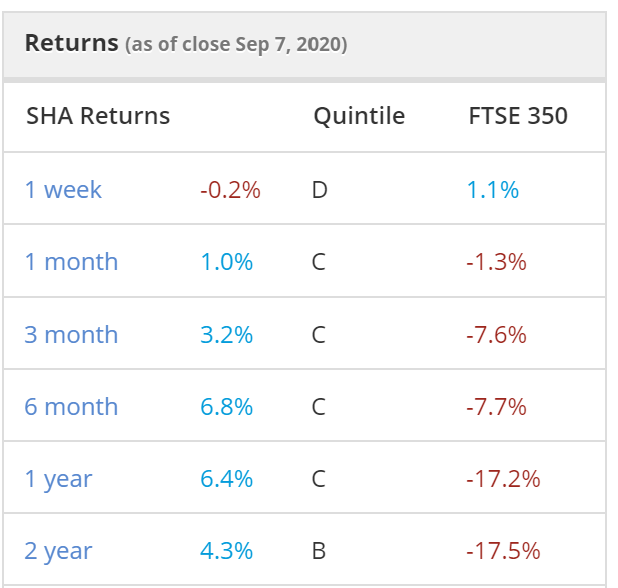

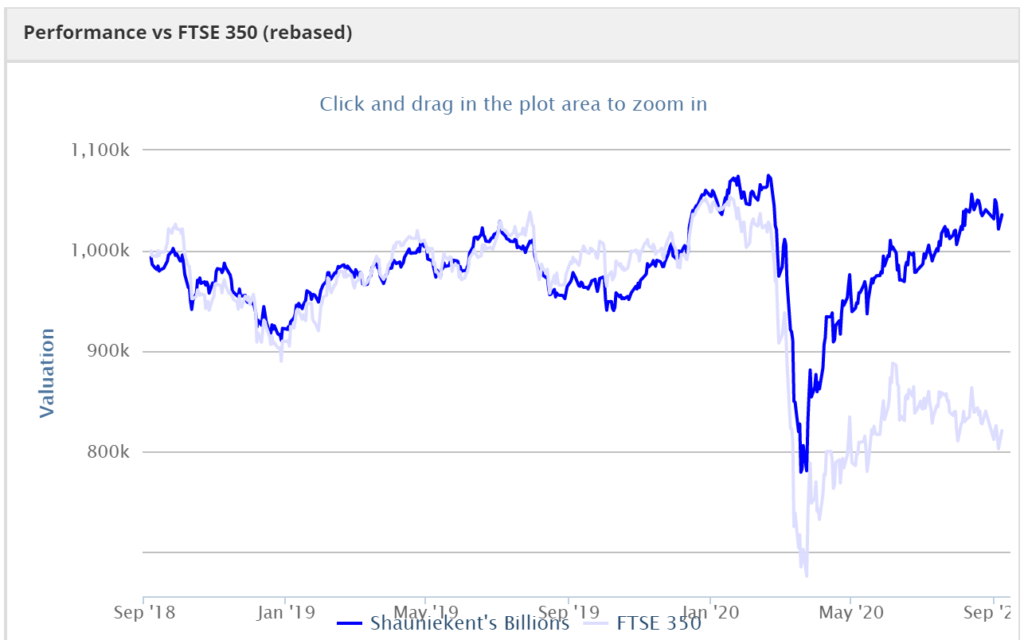

This is the second full year of running this portfolio and im pleased it has outperformed compared to slight underperformance in it’s first year.

A reminder of the portfolio criteria:

- Approx 20 companies. Each stock circa 4.5% position.

- Each company must be >£1billion market cap

- Pick of 2 stocks from each of Stockopedia’s ten sectors with stockrank >90. If there are none I will relax this to SR>80. If there are still no matches, I will not select a company.

- I may choose up to 3 companies above $1m market cap at entirely my own discretion

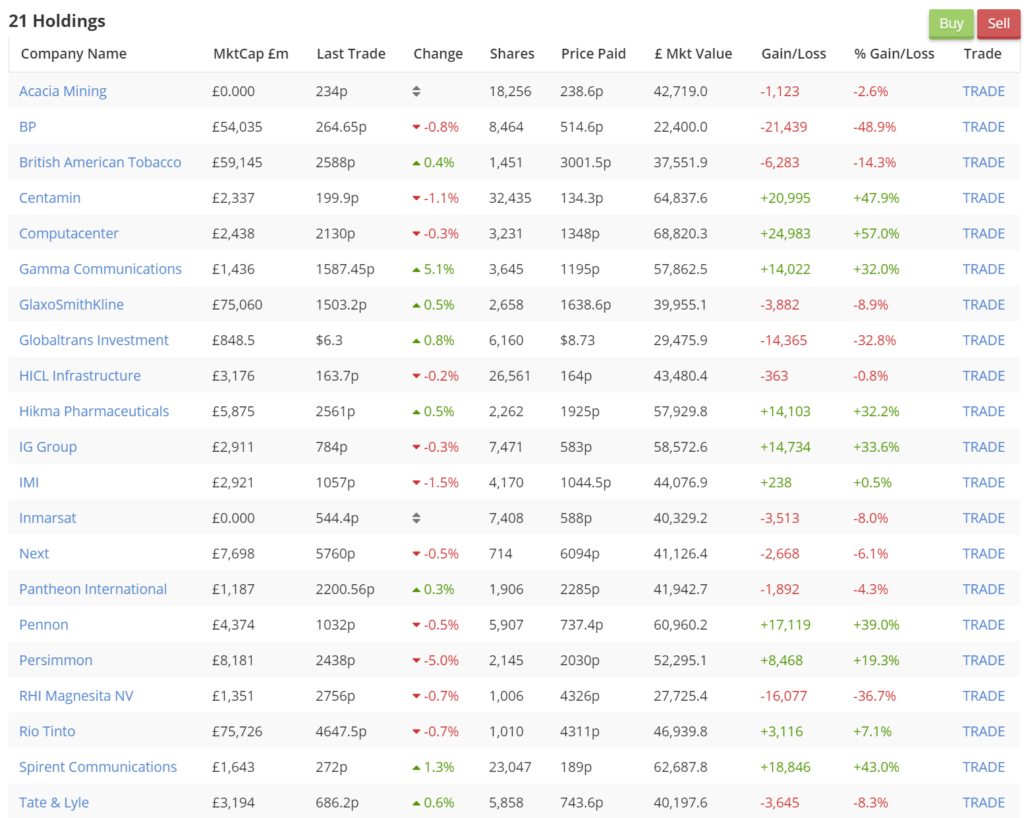

Over 20% outperformance is partly driven by my discretionary choices to invest in gold miner Centamin and stockbroker IG Group which were 4th and 5th best performers.

Note: Acacia mining was bought by Barrick shortly after this years selections were made with shareholders being swapped into Barrick shares. If this was reflected in the portfolio(rather than assuming position frozen at buyout calculated value), this position would havegrown another 60% over the year.

The individual returns look like this:

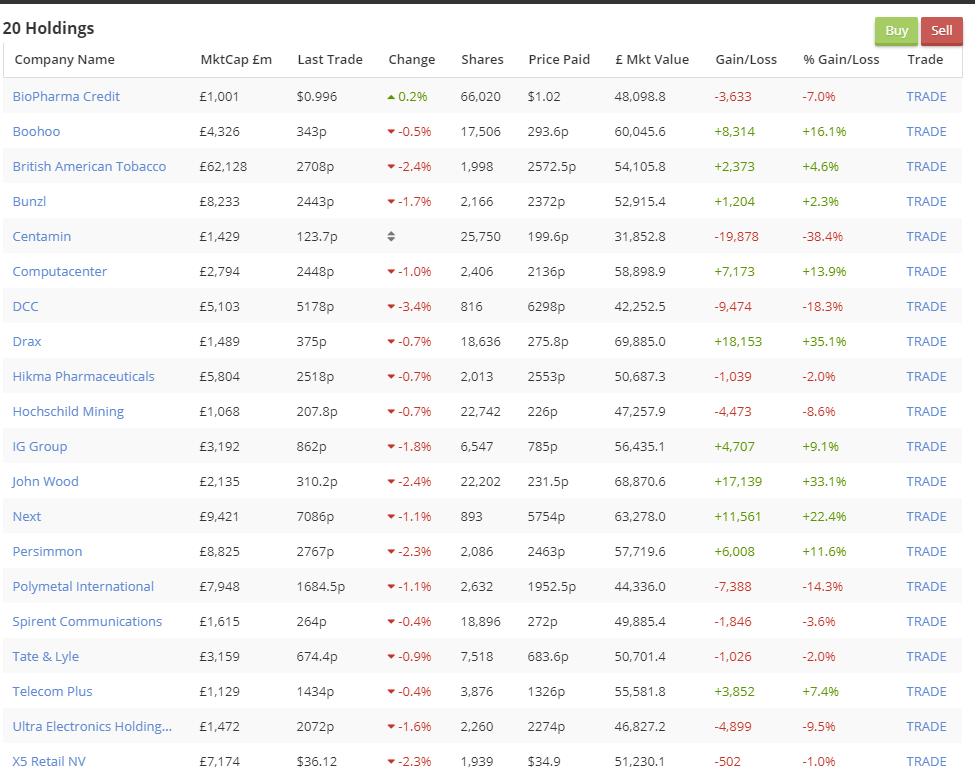

This years picks

Following portfolio rules i have selected the below for 2020-21. There was only one company available for selection within healthcare and none within telecoms. My discretionary choices were BATS, HOCH & BOO making a total of 20 selections.